Amended Returns

Columbus, GA

Amended Tax Return Services in Columbus, GA

Made a Mistake on Your Taxes? We’ll Fix It.

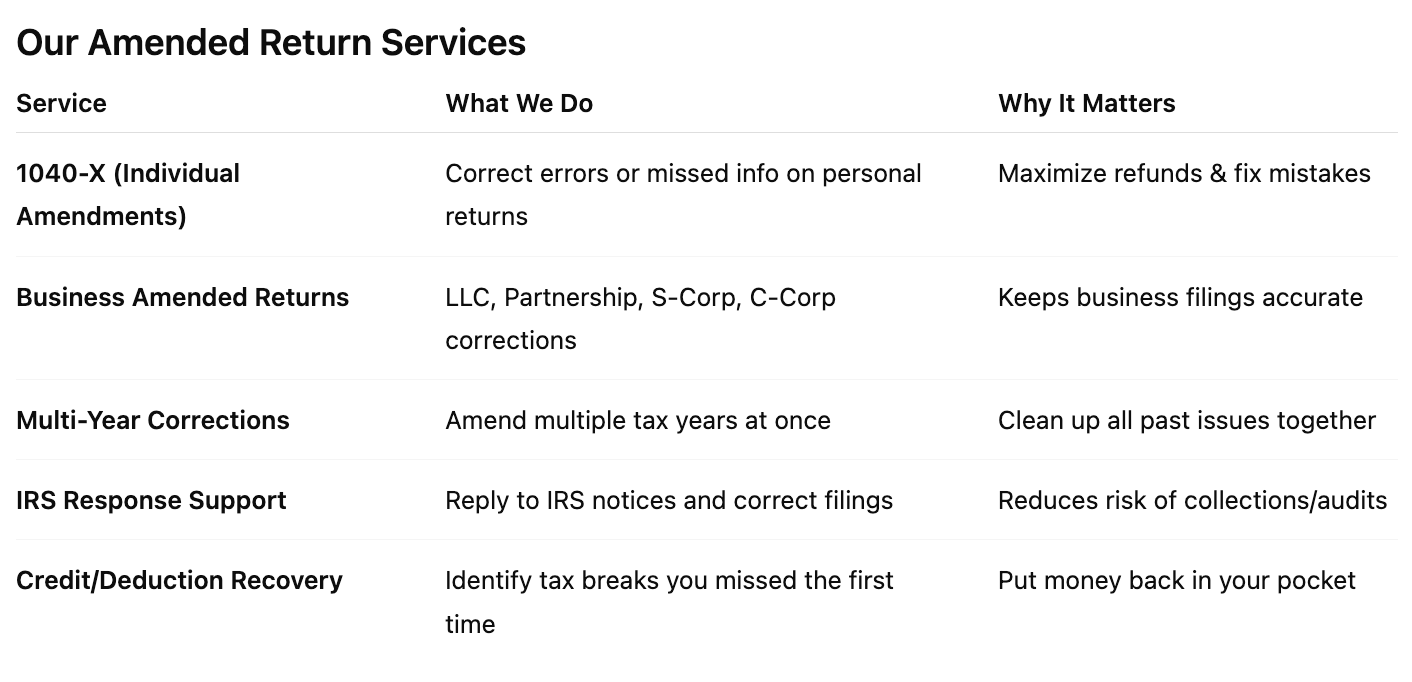

Tax laws are complex, and mistakes happen. Whether you forgot a deduction, reported income incorrectly, or the IRS flagged an error, you don’t have to panic. At Taxes Done Right in Columbus, GA, we specialize in preparing amended tax returns (Form 1040-X and business amendments) so you can correct errors, reduce penalties, and even claim money you might have left behind.

Why File an Amended Return?

You may need to amend your tax return if:

- You forgot to claim deductions or credits

- You received a late W-2 or 1099 after filing

- Your business structure changed mid-year

- You reported income incorrectly

- The IRS adjusted your return and you disagree

- You qualify for a refund you didn’t claim the first time

Benefits of Amending Your Return

- Recover refunds — If you overpaid, the IRS may send money back (within 3 years of original filing).

- Avoid penalties & interest — Correcting mistakes early prevents bigger issues later.

- Stay compliant — Keeps your tax history clean and reduces audit risk.

- Peace of mind — Knowing your taxes are accurate helps you focus on life and business.